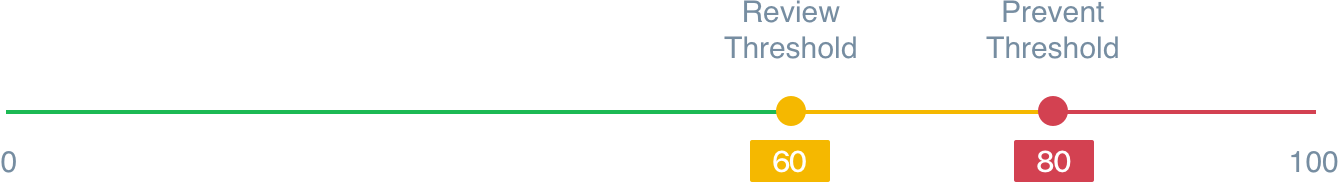

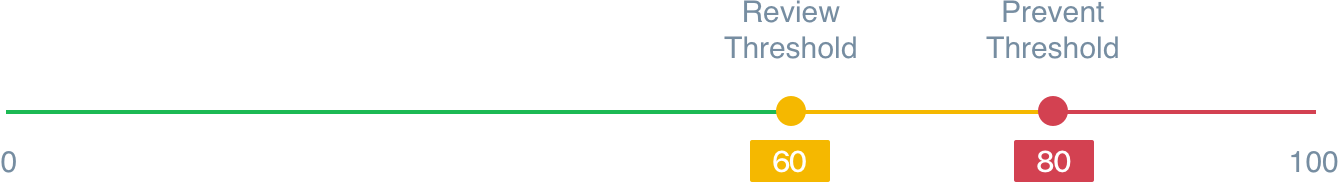

Fraud score thresholds allow you to decide to what extent the Fraud Scores should impact your customers. When we initially set up your integration, we'll work with you to decide these thresholds, which may vary depending on your risk appetite.

The Fraud Score thresholds decide what recommendation your customers should receive based on their fraud score. If a customer receives a Fraud Score greater than the Prevent threshold, then they will receive a Prevent recommendation. If their fraud score is between the Review and Prevent thresholds, they will receive a Review recommendation. Below the Review thresholds, they will receive an Allow recommendation.

In this example, a Review threshold is set to 60, while the prevent threshold is set to 80. Therefore the ranges would be as follows:

The Payment Fraud Score recommendations normally sit at the lowest priority level in the rule hierarchy, so if any other recommendation reason disagrees with them on the recommendation action, then the other recommendation reason is likely to be carried out instead. For example, a customer with a low payment fraud score may receive an allow recommendation based on their payment fraud score, however be Prevented due to another Rule.